Dear Friends

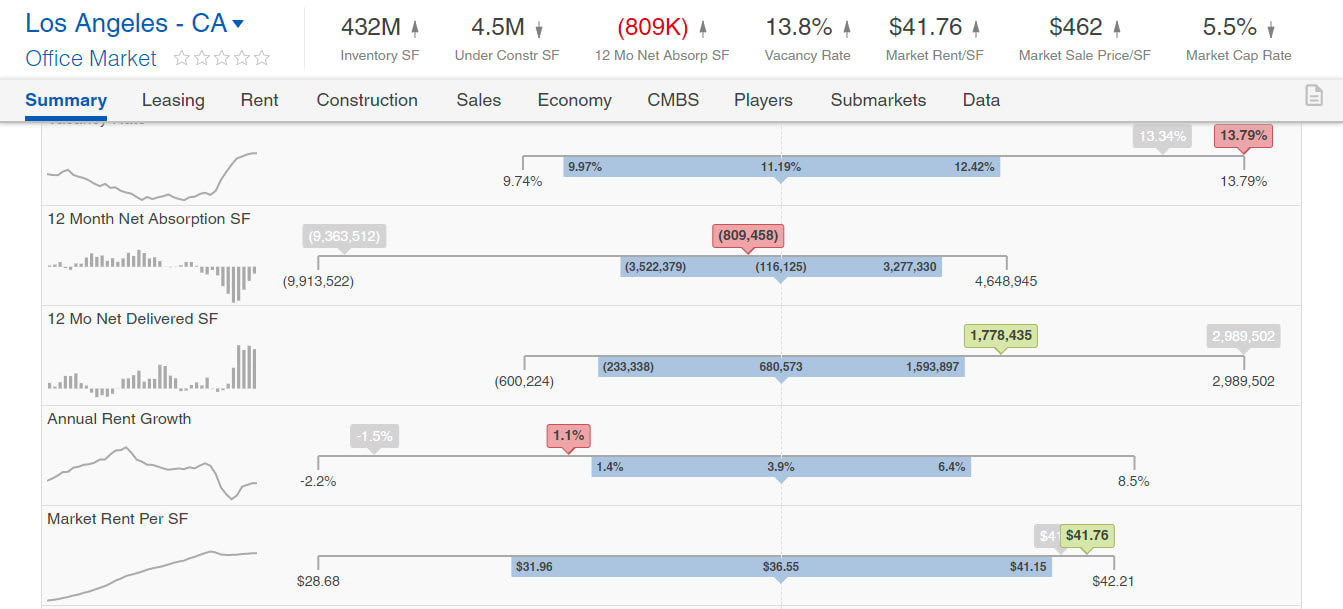

I’ve had investors ask about what is happening with the office market in Southern California as everyone is going back to work. I wish I could say things were different. Conditions continue to deteriorate in Los Angeles' office market. Vacancies are at a 25-year high, and sublease space continues to track at near-record levels. Rental rates are down from a peak in 20Q1. While rates have held flat since the second half of 2020, concessions and other incentives have been more generous for tenants than those offered prior to the pandemic.

Current office construction levels have come down from recent peaks, but activity remains relatively high. Projects with little preleasing may be hard-pressed to secure tenants in the current leasing environment. Developers have demonstrated restraint in starting new projects in recent quarters, suggesting there are concerns about the future trajectory for office demand.

In recent months, office sales volume in L.A. has been robust and in line with pre-pandemic levels. Investors have largely focused on high-quality, well-leased properties since the onset of the pandemic, but there have been several recent notable sales that show investors are purchasing properties to implement riskier value-add strategies. Average market pricing per SF flatlined starting in early 2020 through most of 2021, but pricing has recently been on the rise. Several recent large transactions of higher-quality assets garnered strong pricing and suggest discounts will not become the norm for all office sales going forward.

The Los Angeles office market is unique among major markets nationally for the decentralized nature of its office stock. This is a product of the sprawling nature of the metropolis as well as its well-earned reputation for having some of the nation's worst traffic. Companies need to be strategic in where they locate. The most prestigious office locations have long been on the Westside. Properties in submarkets such as Century City, Beverly Hills, and Brentwood evoke a certain cachet and typically attract more traditional and image-conscious tenants. Los Angeles' tech epicenter, Silicon Beach, is located west of these submarkets and includes Santa Monica, Venice, Marina Del Rey, and Playa Vista.

If you, or a friend, are thinking of selling or wondering what the value is of your office building, give us a call. Your office building may be worth a lot more than you think. The Ponce Real Estate Group will find ways to add value to the property and help you do a 1031 Exchange.

We also want to welcome Erin Blakeslee to The Ponce Real Estate Group here at Coldwell Banker. She brings in nearly ten years of very high-end luxury property experience to the group and has the acumen with working with high-net-worth individuals, and that will carry over very well with the commercial properties we deal with. Call us today for an evaluation.